how much does the uk raise in taxes

The amount people can earn before paying. A large chunk of what UK drivers pay for fuel goes directly to the government.

Types Of Tax In Uk Economics Help

The Chancellor announced this will keep going until 2020 2027.

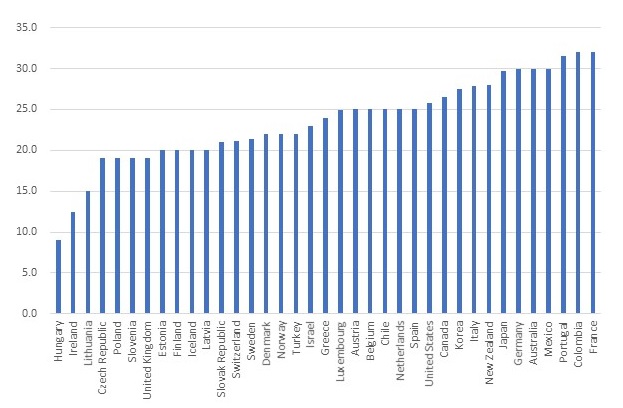

. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019. A 40bn tax rise would be the equivalent of an increase of 7p on the basic rate of income tax or an increase of six per cent on VAT he said. Overall the average household pays 12000 in tax and receives 5000 in benefits.

What is the tax increase for. The government says the changes are expected to raise 12bn a year. In our latest forecast we expect landfill tax to raise 08 billion in 2019-20.

In 2019-20 VAT raised 134 billion this measure of VAT excludes refunds of VAT made to certain public sector organisations. How much money does Scotland contribute to the UK in taxes. These studies suggest a range of between 3 and 6 billion costs to the NHS but theres too much uncertainty in the estimates to rely on these bounds or.

Taxes on different forms of consumer spending provide the second biggest source of revenue for government with VAT value added tax by far the biggest of those. So how much tax revenue does the UK make. The dividend ordinary rate will be set at 875.

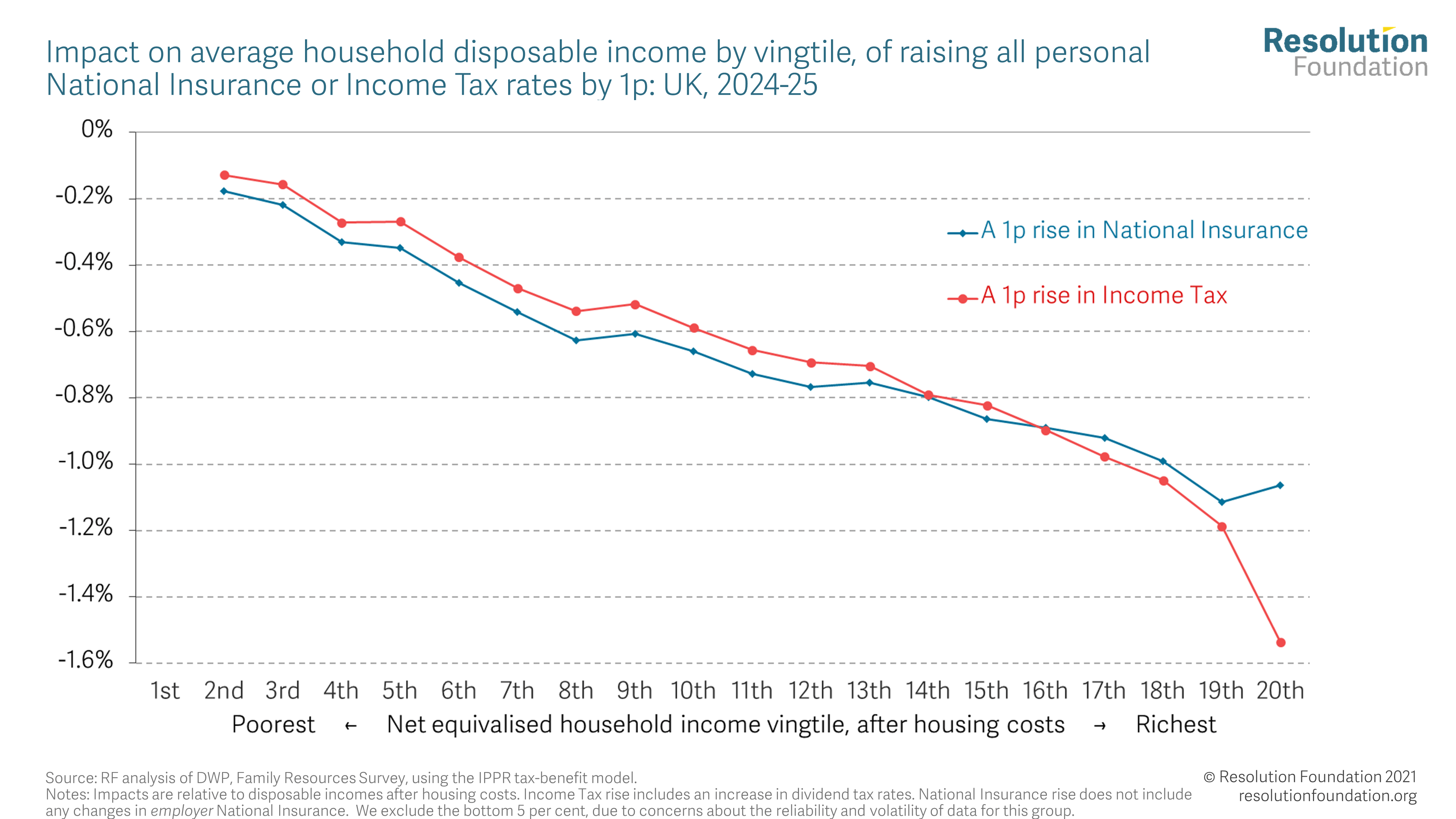

Thus if the UK increased income tax by 1 of national income approximately 20 billion it would still be a long way below the levels seen in Scandinavia. However Boris Johnson said the increase was because of Covid and the burden it placed on the NHS. But receive over 5000 in tax credits and benefits.

They receive around 2000 in benefits. Generally the First Budget of a new year does not differ greatly from the last Budget. UK tax revenues were equivalent to 33 of GDP in 2019.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. In line with inflation there will be an increase in allowances and the basic rate limit. The richest 10 pay over 30000 in tax mostly direct income tax.

How much does fuel really cost. That would be an extra 91000 in tax revenue per person. If youre not a taxpayer for example you dont earn enough to pay income tax but are contributing to a pension youll still have the tax saving added to your contributions up to a certain amount.

Without this fuel tax petrol and diesel would be quite cheap. Official UK figures show that in the first week of October 2020 the average price of unleaded petrol in the UK was 11326p per litre. For comparison that sum would be worth 245billion today based on historic inflation.

We expect 781 per cent of this total to come from UK Government landfill tax with the remaining 167 and 52 per cent coming from the Scottish landfill tax and Welsh landfill disposals tax respectively. However inequality in the UK has increased since 1980. The amount you can earn without paying tax - known as the personal allowance - will stay the same from 2022 to 2026 instead of the usual small increases.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. The earliest records held at the Institute of Fiscal Studies are for the tax year 197879 when the UK Government raised 49billion in VAT. This represented 7 of the governments total revenue in that year.

That represented 162 per cent of all receipts and. In 202021 the value of HMRC tax receipts for the United Kingdom amounted to approximately 556 billion British pounds. Clark Apr 29 2021.

Of tax revenue between the UK and Scandinavia is income tax the UK government gets 91 of national income in income tax compared with an average of 160 in Denmark Norway and Sweden. Johnson said the 20 basic rate of income tax could be increased by two or three percentage points and that the 40 higher rate could also go up. From 229 in total income taxes it is anticipated that receipts will increase.

Scottish taxpayers paying slightly higher rates of income tax 21 41 or 46 than elsewhere in the UK also need to claim their extra tax through their tax returns. On this one there will be no impact to the tax filing status. Other research put it as high as 52 billion in 200506 about 62 billion today.

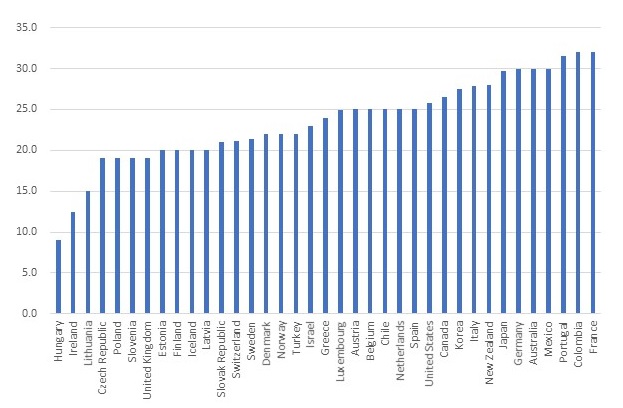

How much does the UK raise in tax compared to other countries. Any such change would break the Conservatives. By 2025 26 billion people will have access to.

6 hours agoFrom 2021-22 Personal Allowance amounts will be increased by 70 to 12570 according to government plans. The biggest increase in revenue is expected to come from other non-taxes which includes interest and dividends gross operating surplus and other smaller. Overall its been calculated that tax revenue will total 873 billion in 20202021 63 billion more than in 20192020 810 billion.

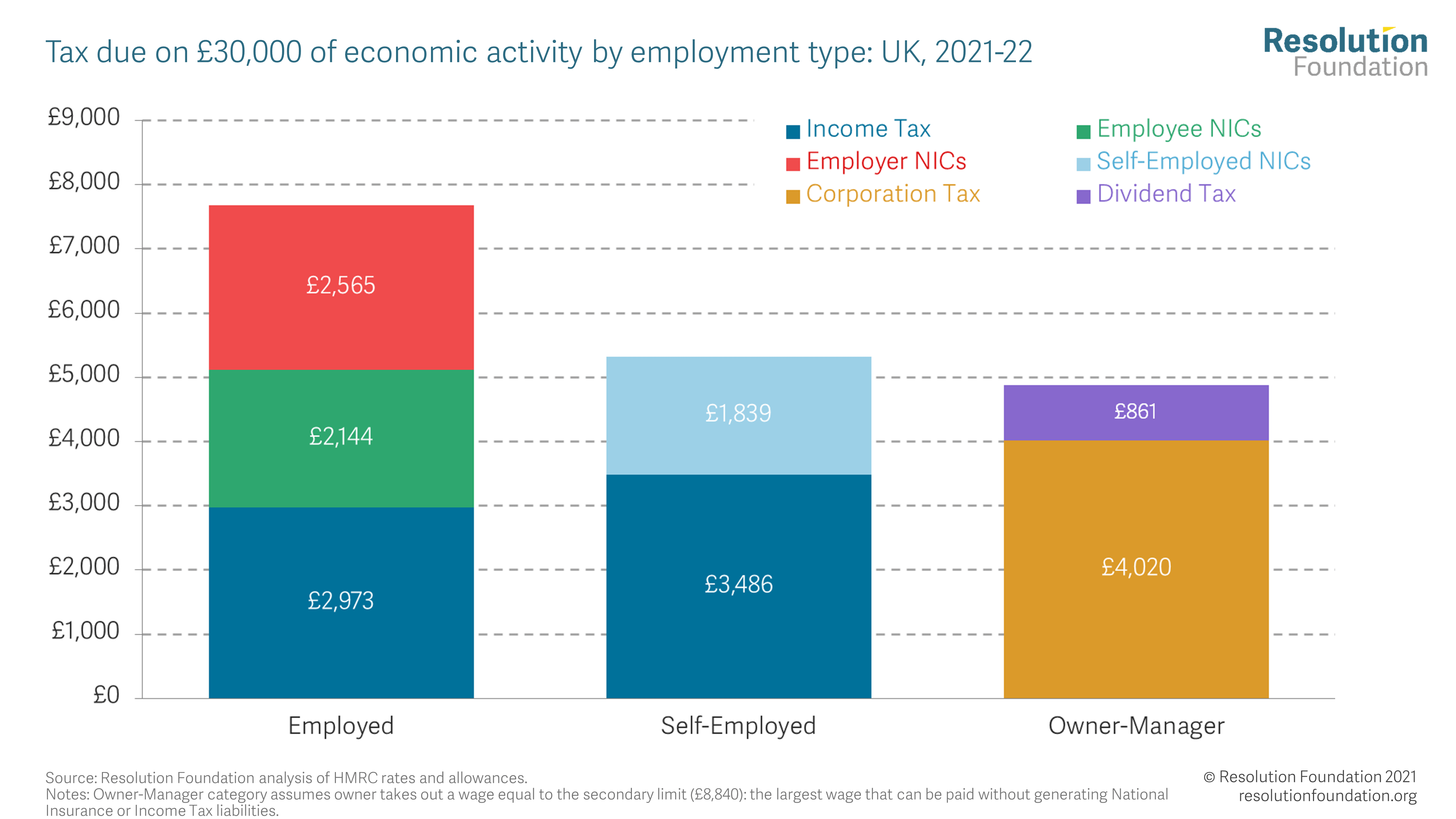

According to the 20182019 Government Expenditure and Revenue in Scotland GERS report tax revenue in north of the border amounted to. From 168 billion in 202122 to 6 billion in 202223. Increases added to the rate applied from 9568-50270 of earnings 12 and to the rate charged on earnings above that 2 It will be extended at that point to cover pensioners who are.

This measure increases the rates of Income Tax applicable to dividend income by 125.

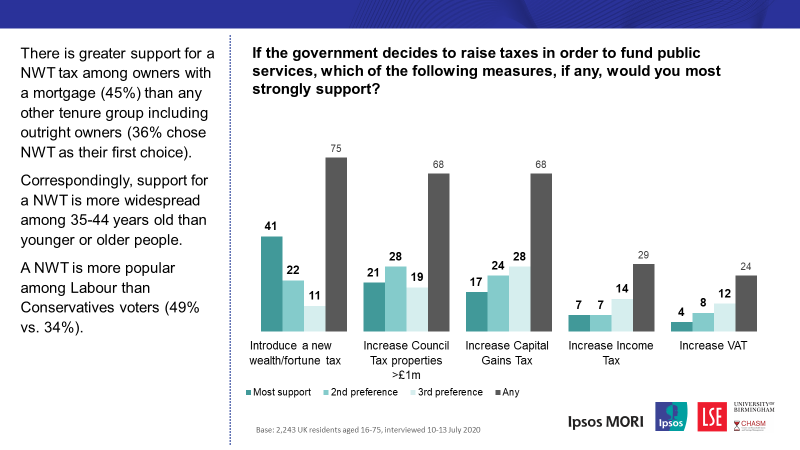

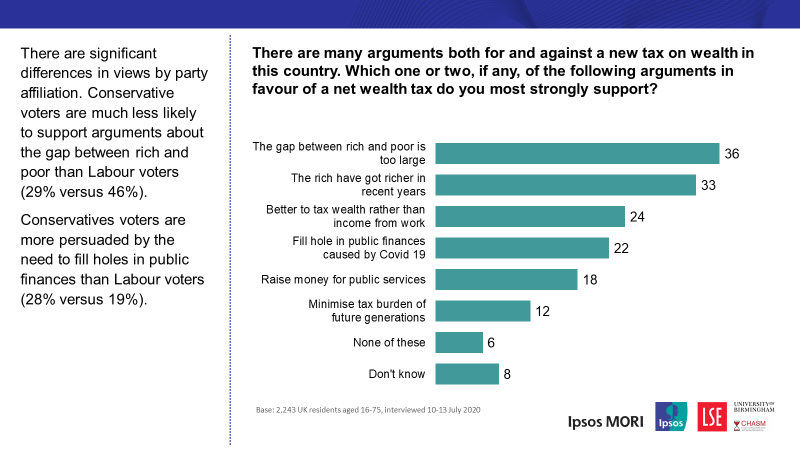

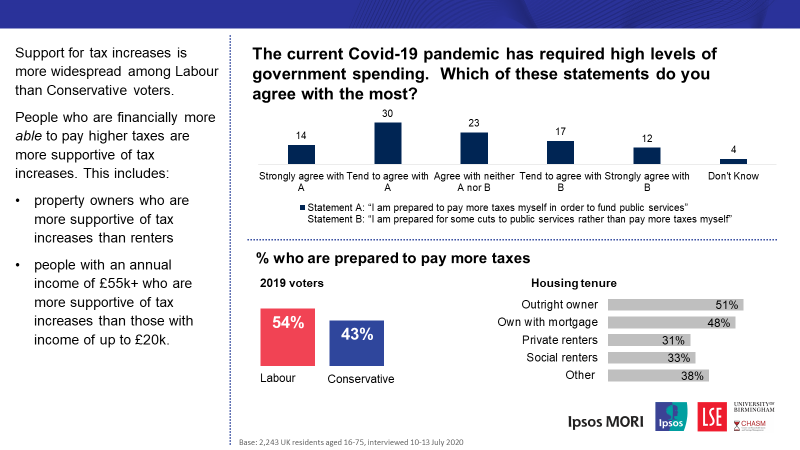

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

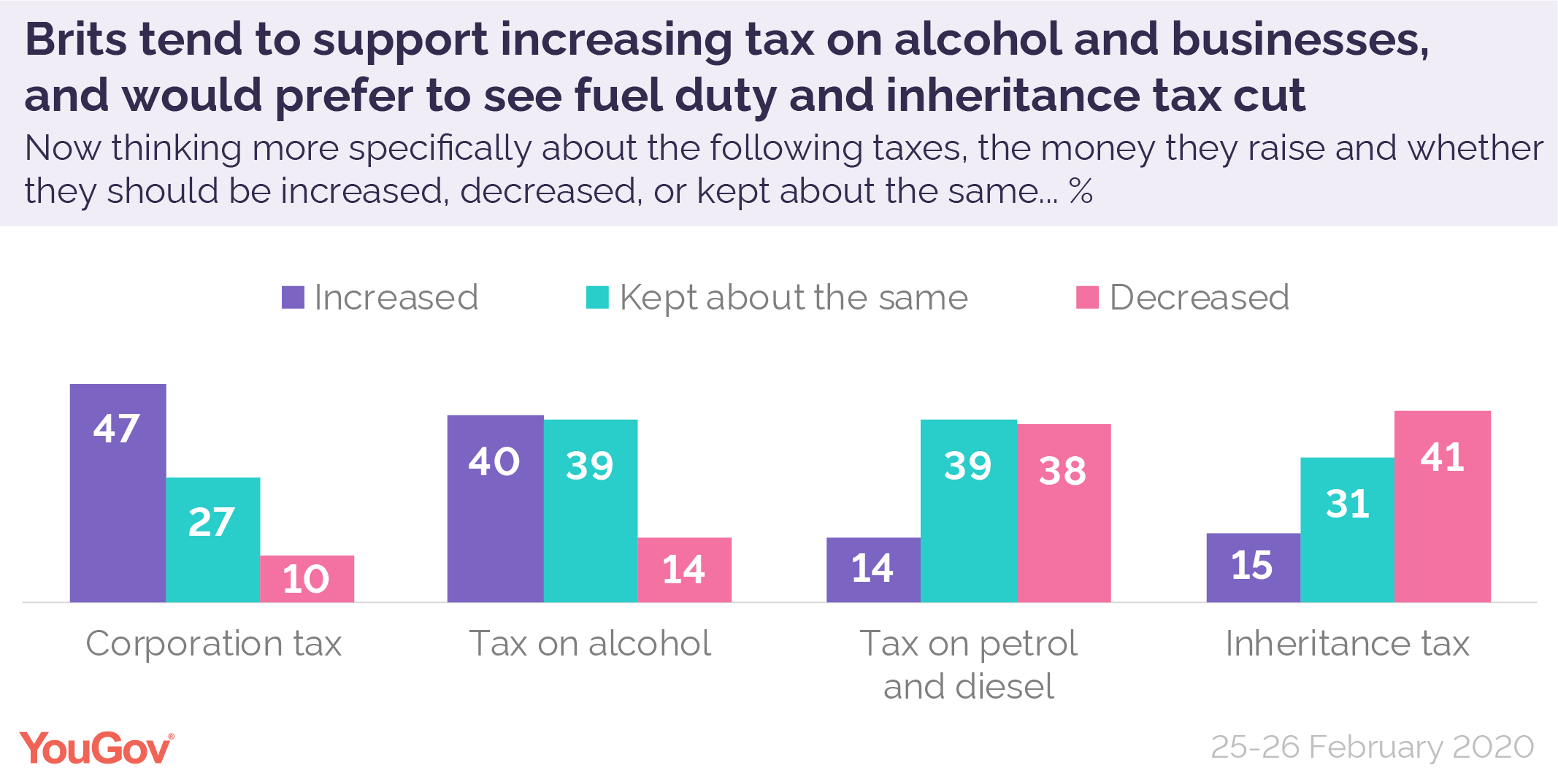

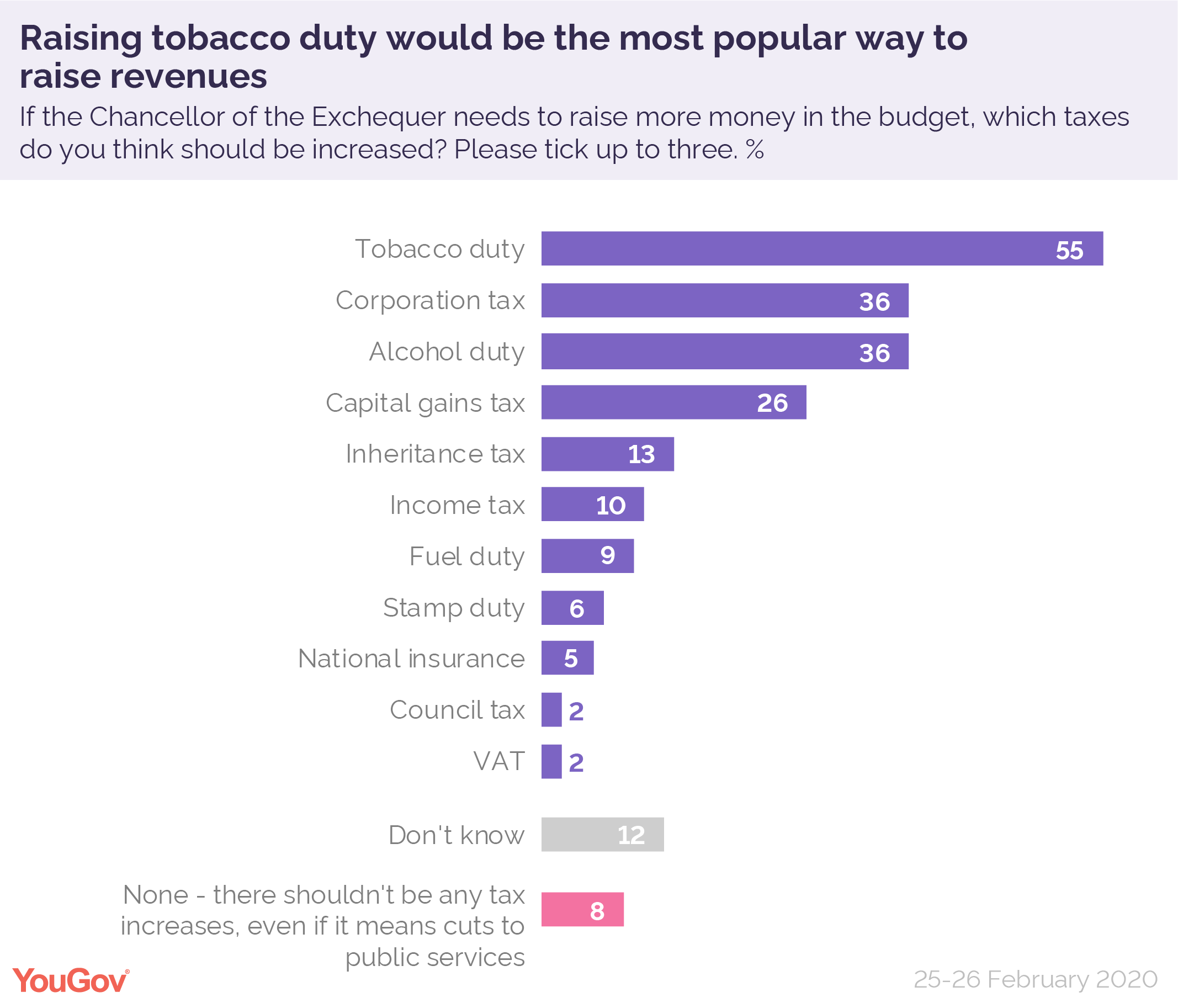

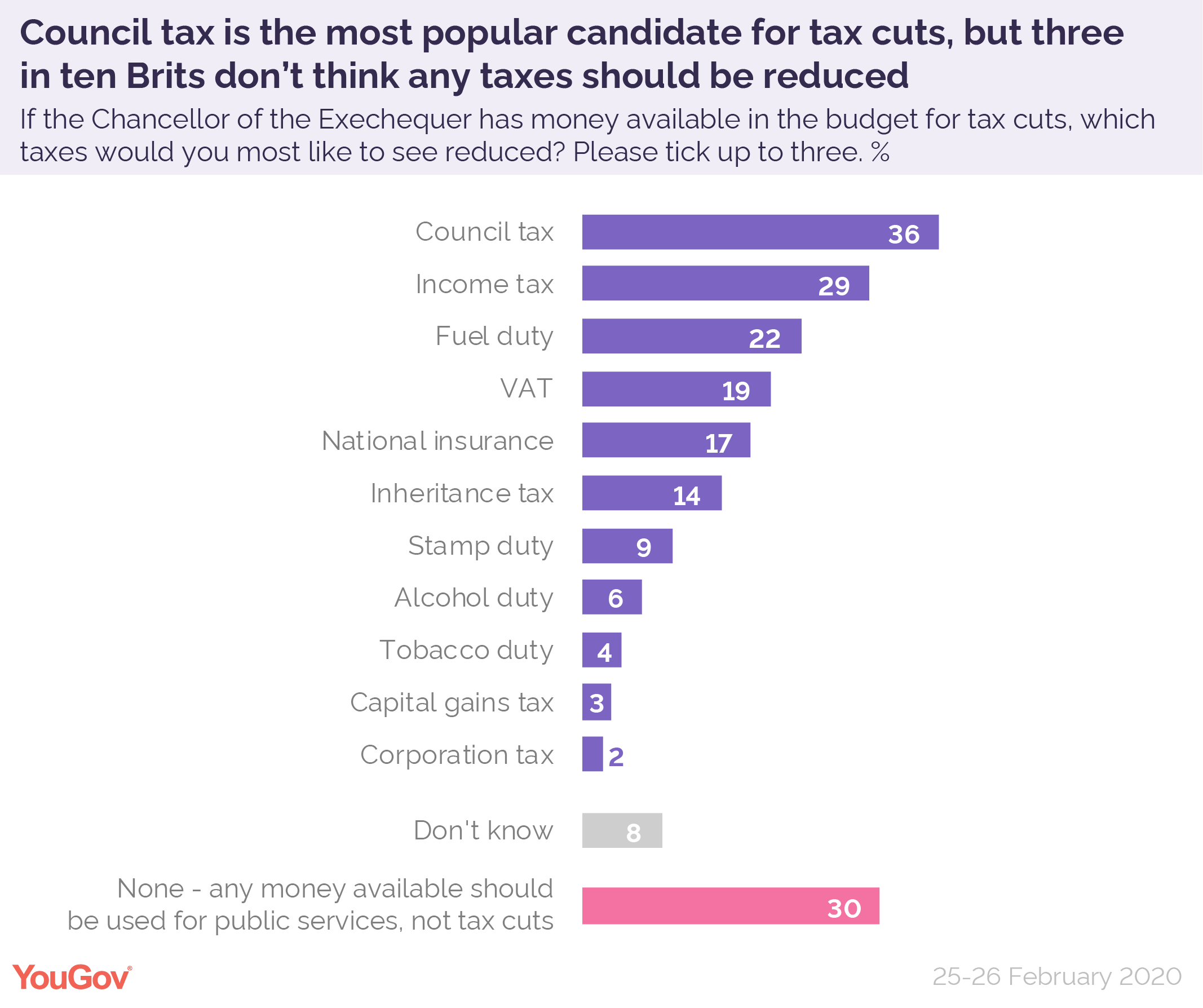

Budget 2020 What Tax Changes Would Be Popular Yougov

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Budget 2020 What Tax Changes Would Be Popular Yougov

Can Countries Lower Taxes And Raise Revenues Laffer Curve Revenue Tax

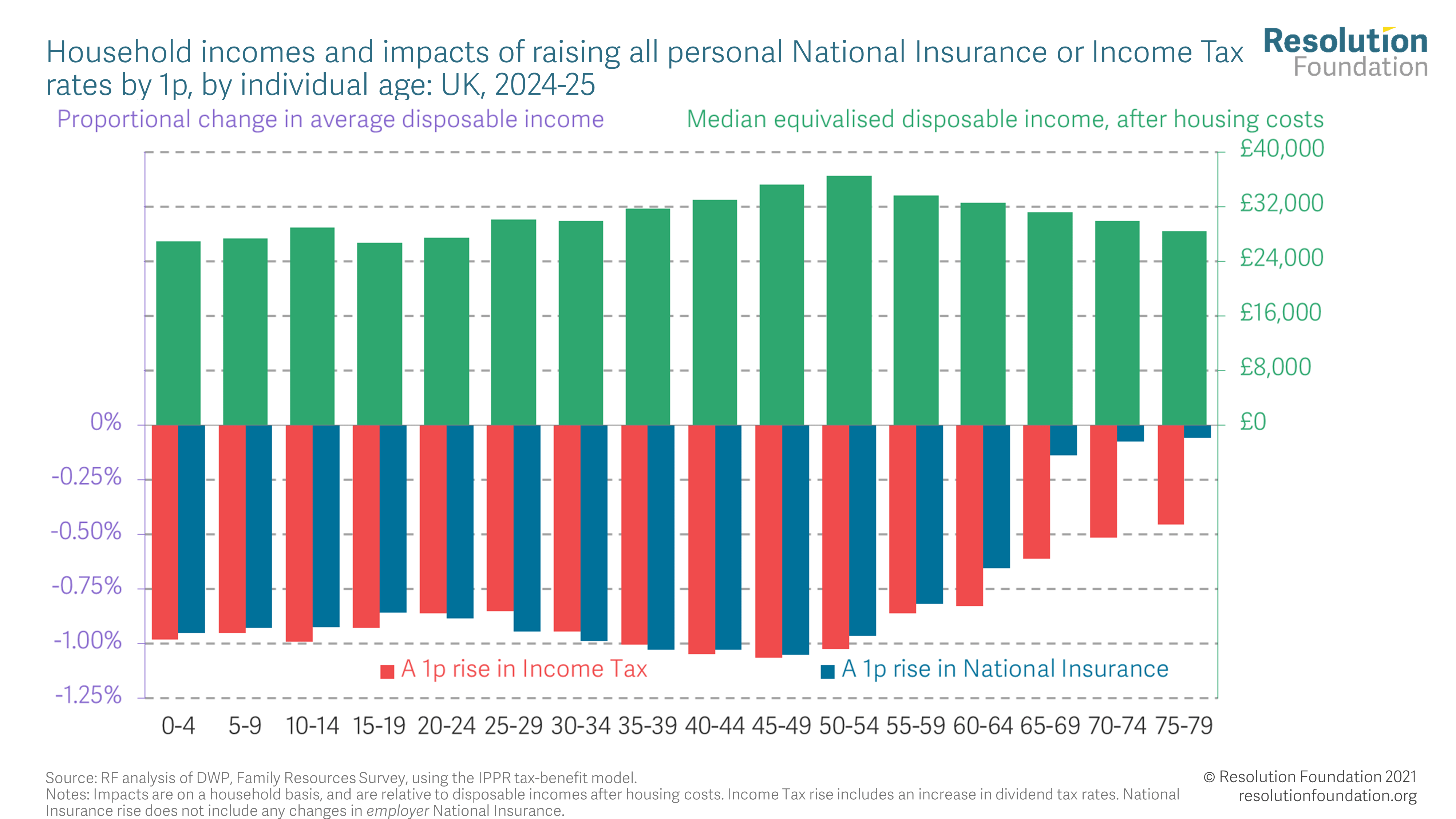

A Caring Tax Rise Resolution Foundation

A Caring Tax Rise Resolution Foundation

Tax After Coronavirus Treasury Committee House Of Commons

Boris Johnson Plan To Fund Health And Social Care Lifts Uk Tax Burden To 70 Year High Financial Times

Council Tax Increases 2021 22 House Of Commons Library

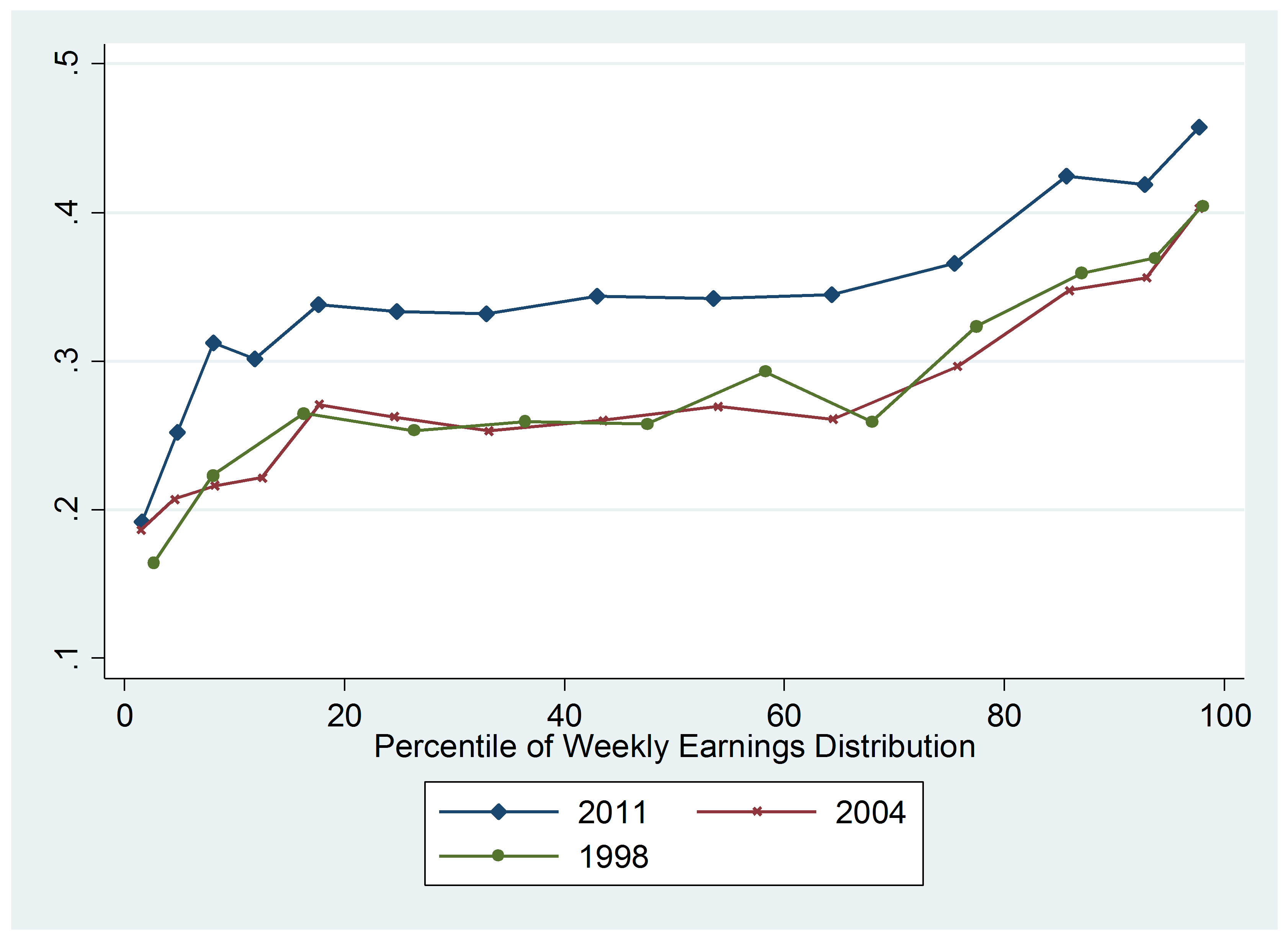

How Do Taxes Affect Income Inequality Tax Policy Center

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Budget 2020 What Tax Changes Would Be Popular Yougov

A Caring Tax Rise Resolution Foundation

Raising Taxes Will Be A Disaster For Britain And Here S The Proof

The Top Rate Of Income Tax British Politics And Policy At Lse

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos